Bullish forecasts for Bitcoin growth by the end of November are likely to no longer be a reality. This was admitted by a cryptanalyst under the nickname PlanB - the author of the famous stock-to-flow model, according to which the main cryptocurrency should have grown to at least 98 thousand dollars by the beginning of December. Now its price is more than 40 thousand dollars behind the planned plan , so there is clearly no need to hope for a miracle in the remaining week of November. Let's talk about what is happening in more detail.

The cryptocurrency market has really looked terrible in recent days. In particular, Bitcoin today managed to sink to the local bottom at $ 54,350. This is the lowest rate since mid-October 2021. Accordingly, the sinking phase really became serious.

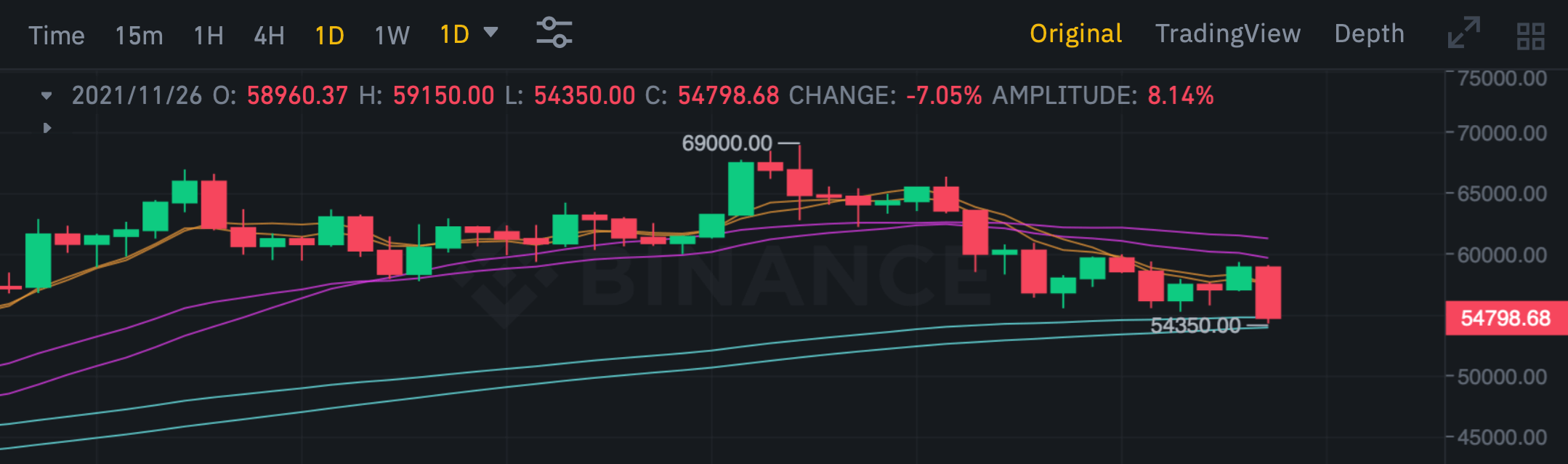

For clarity of the situation, we present the daily chart of Bitcoin. It also shows a historical maximum of the rate at the level of 69 thousand dollars. His cryptocurrency reached November 10, a little over two weeks ago.

Daily chart of the bitcoin rate

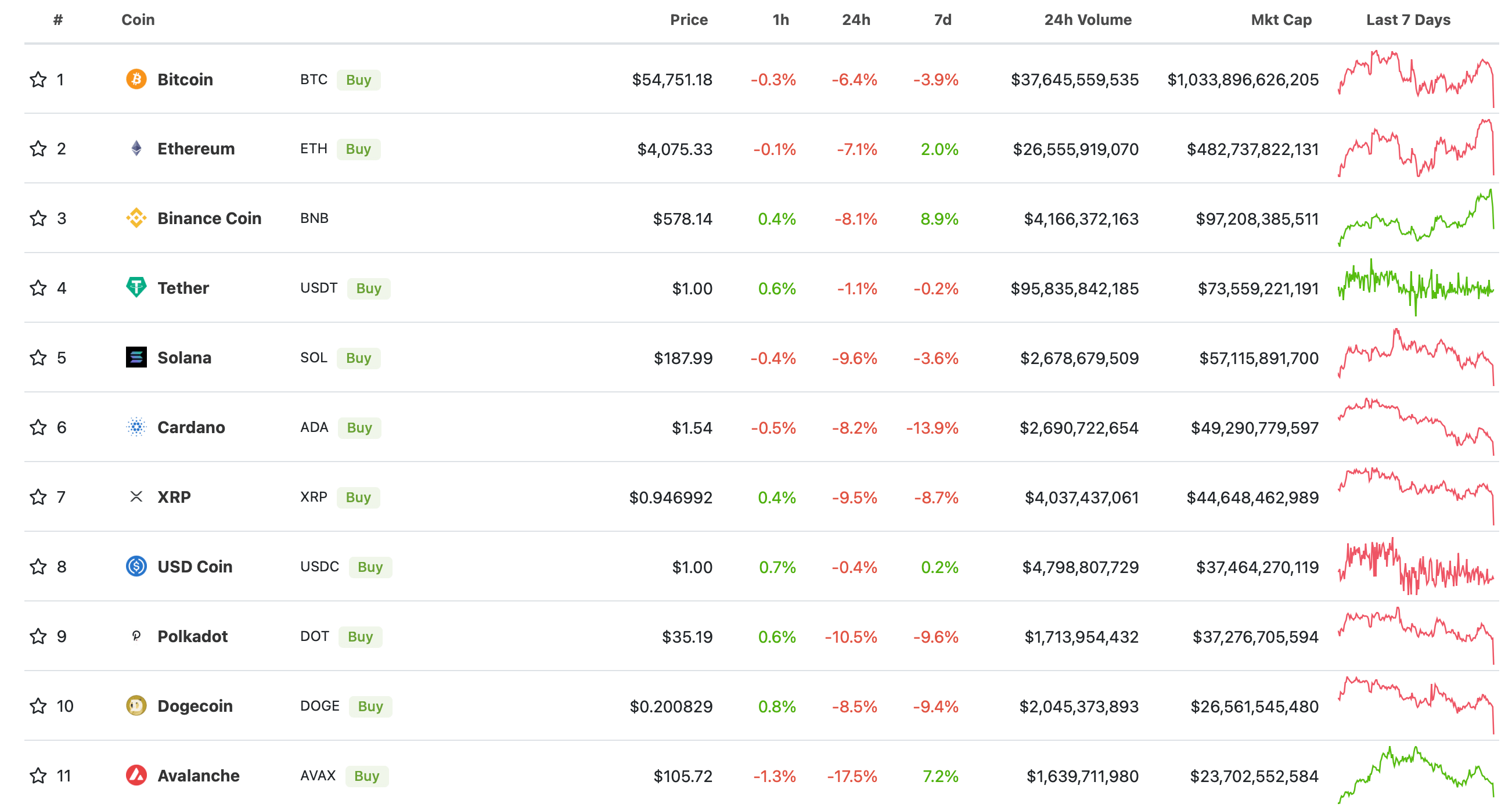

The same goes for most of the top cryptocurrencies by market cap. They sagged on the scale of both the last day and this week. Binance Coin and Avalanche remain the leaders in growth for the week - they have 8.9 and 7.2 percent increases, respectively.

Rating of the main cryptocurrencies by market capitalization

What will happen to Bitcoin?

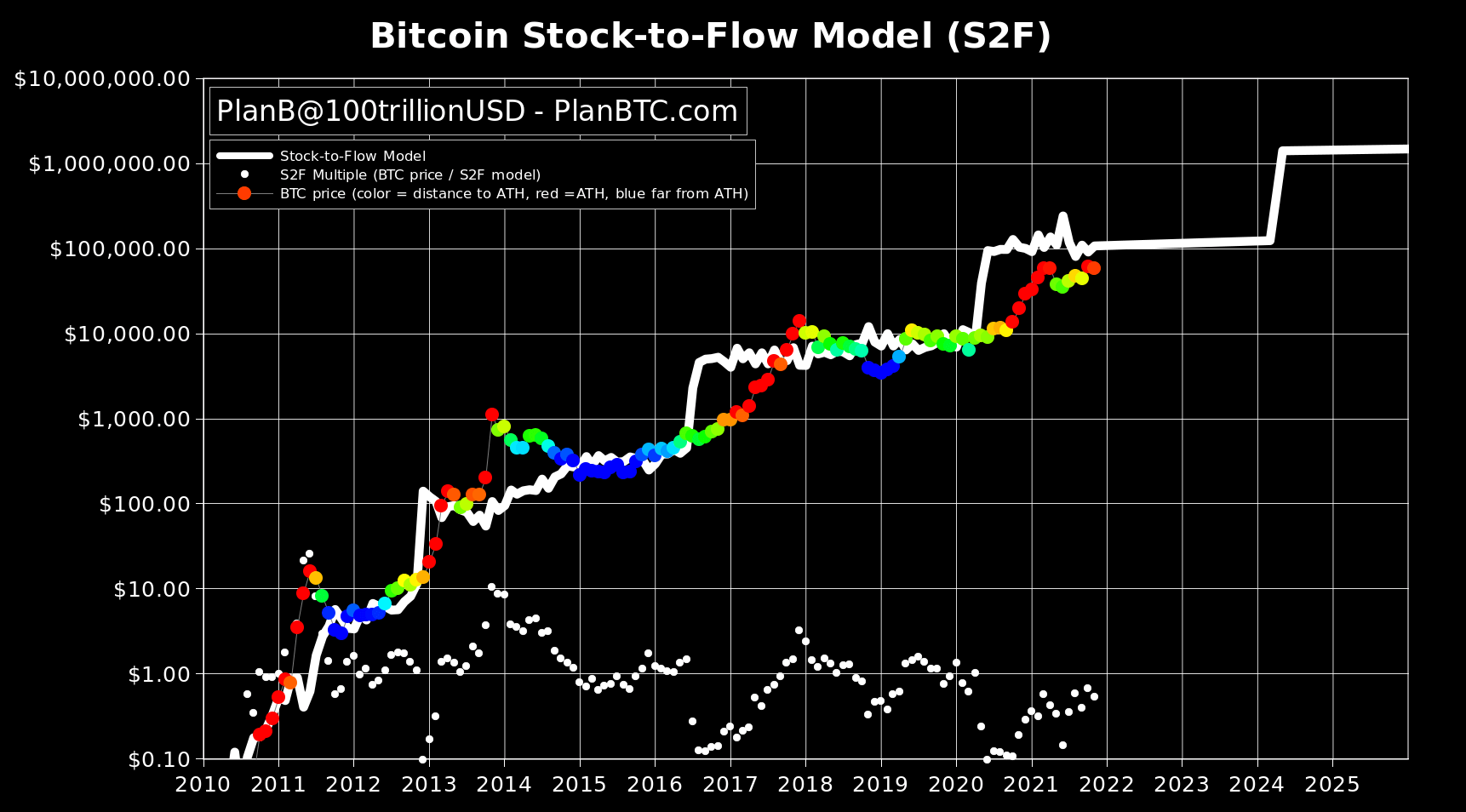

By tradition, let's start with an explanation. Stock-to-Flow is the ratio of the stocks of an asset to the inflow of capital, that is, the supply of cryptocurrency in circulation to the volume of funds entering the niche. The maximum supply of Bitcoin is limited to 21 million coins , while at least several million of them have already been lost forever. But the demand for crypto can be very high, which in theory will lead to an increase in the value of BTC up to hundreds of thousands of dollars in the coming years.

Note that this conclusion is built in accordance with the classical model of supply and demand ratio. While it sounds logical, it is difficult to guarantee anything in the cryptocurrency market. In addition, the alternation of bullish and bearish cycles has not been canceled.

Stock-to-Flow Model

The outlined long-term plan for the market dynamics of BTC quite accurately coincided with reality in recent years. However, PlanB has now admitted that there were problems with the new item in its forecast. Here is his remark, in which a popular analyst shares his vision of the current situation. It is quoted by Cointelegraph .

If we don't reach $ 98K by the end of November, this will be the first mistake my indicator has made in the entire history of Bitcoin.

There are four full days left until the end of November. And given the current state of the market, hoping for BTC to almost double is too optimistic.

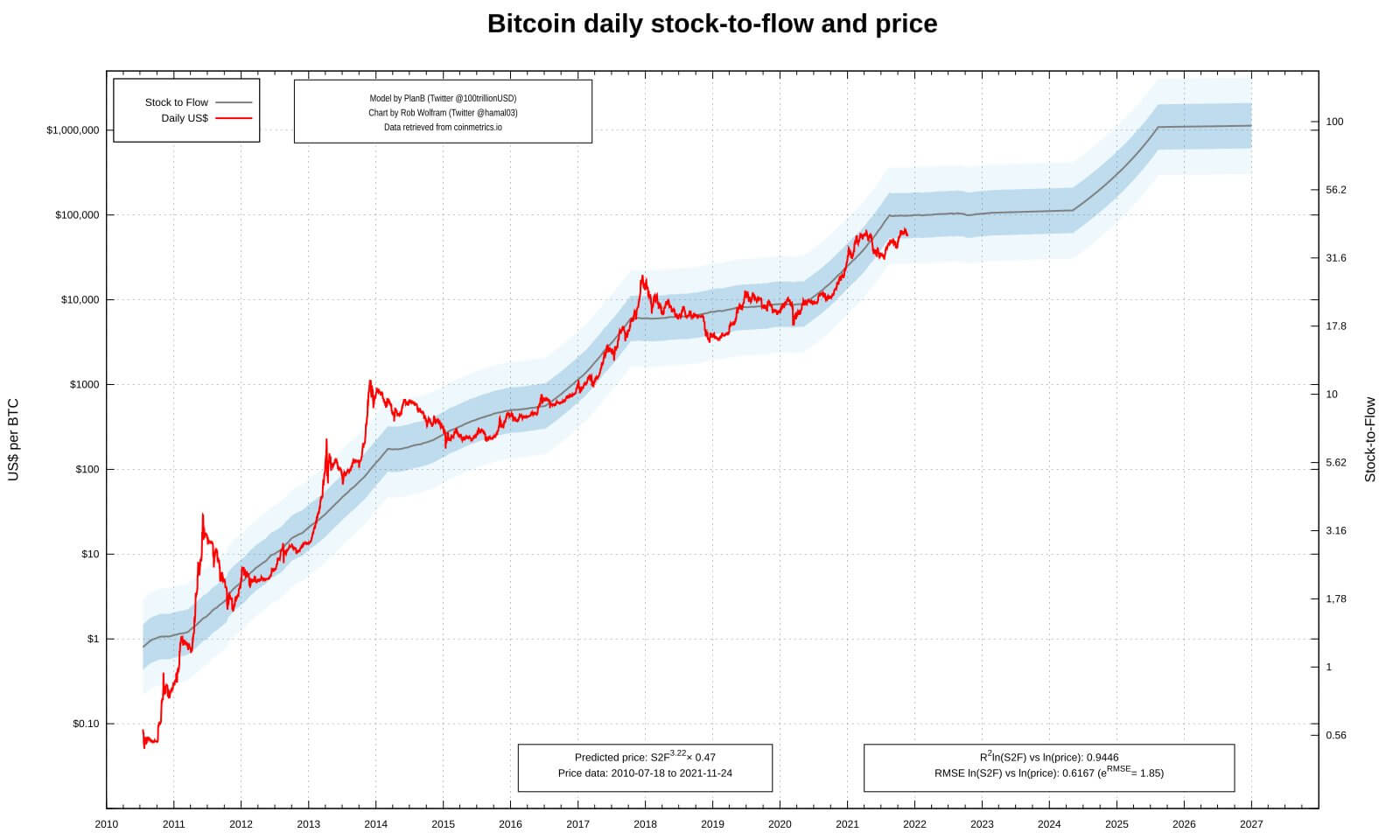

As a reminder, prior to that, PlanB successfully predicted BTC closing prices at $ 47, 43 and 63 thousand in August, September and October, respectively. Another analyst model called stock-to-flow cross-asset (S2FX) suggests that the Bitcoin chart will rise to at least another $ 288K by the end of this bullish cycle.

Model S2FX

If this forecast does not come true, crypto investors still have little to complain about: since the beginning of this year, the price of BTC has more than doubled from the $ 29,000 mark. This is an excellent profitability by the standards of traditional finance, so it is possible that the crypto market will continue to attract new large investors. Well, this will traditionally affect the value of digital assets.

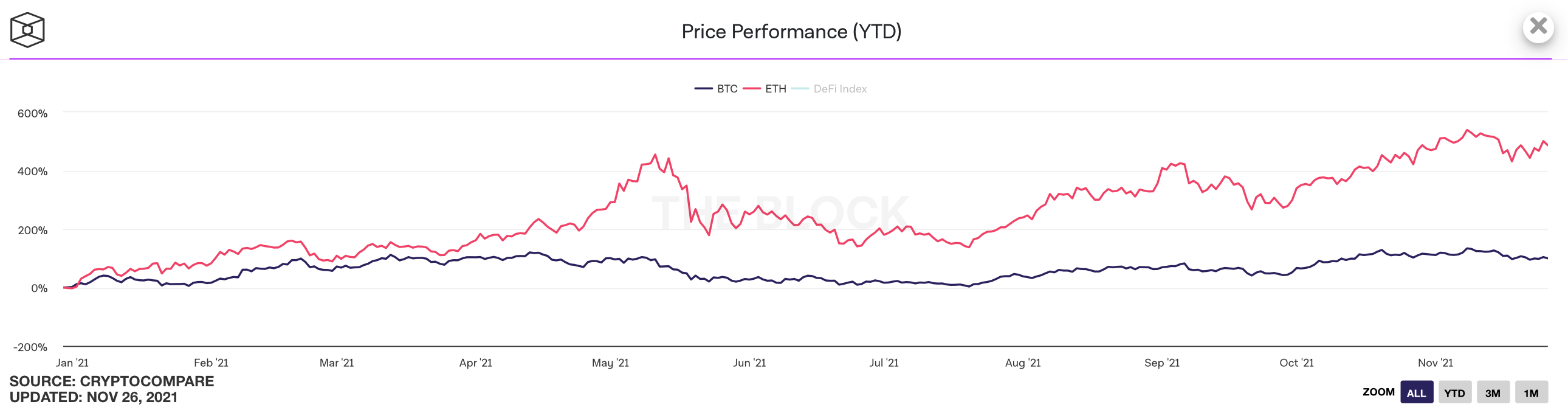

We checked the actual data: since the beginning of the year, the Bitcoin rate has increased by 99.58 percent, while the yield on Ethereum was 486.66 percent. Naturally, you still need to try to find such indicators in the world of traditional investment instruments. So, cryptocurrency holders need to remember that early buying of coins at a low rate is almost always the key to success.

The graph of changes in the exchange rate of Bitcoin and Ethereum since the beginning of the year

We believe that this situation once again reminds of the unpredictability of the cryptocurrency industry. Predicting anything here is too risky for your reputation. However, it is even more dangerous to blindly follow promises and not defend against possible risks in any way. In this regard, we recommend that you conduct your own market research and make financial decisions solely on your own. This will allow you to take responsibility and not depend on your Twitter lines.

إرسال تعليق