According to recent research on the Topaz Blue and Bancor Protocol platforms, the problem of impermanent loss is relevant for almost half of the liquidity providers of the UNISWAP v3 decentralized exchange (DEX) . Thus, for them, simply holding assets would be more profitable than maintaining liquidity on the platform. Let's talk about the situation in more detail.

The Uniswap exchange and many other decentralized exchanges are automated market makers (AMMs) - that is, protocols that use smart contracts to automatically conduct transactions without the involvement of a centralized authority. These trades are conducted using an algorithm, not a trade order book like on traditional exchanges. We wrote more about how Uniswap works in this article. We recommend that you familiarize yourself in order to better understand what is happening in the niche.

As a result, the market is created by liquidity providers. These are people who, in fact, share money for a certain trading pair, which other market participants trade with. The peculiarity is to share the equivalent volume of two cryptocurrencies. For example, if a person sends one Ether to liquidity for the ETH / USDT pair, they must also report $ 4,320 in USDT at today's Ethereum exchange rate. Thus, the market is balanced.

What is Impermanent Loss?

An unrealized loss (impermanent loss, or IL) is a loss of funds faced by liquidity providers due to the volatility of a trading pair on a decentralized exchange. As we have already noted, liquidity providers or LPs are people who deposit funds in DEX pools in order to profit in the form of commissions from trades.

AMMs are governed by a mathematical algorithm that automatically balances the ratio of assets in the pool at 50:50 and thereby determines their value. For pricing, the formula X x Y = K is used, where X and Y are two different assets, and K is a constant value that must remain the same before and after the transaction . To understand how IL originates, consider a simple example of a liquidity provider working.

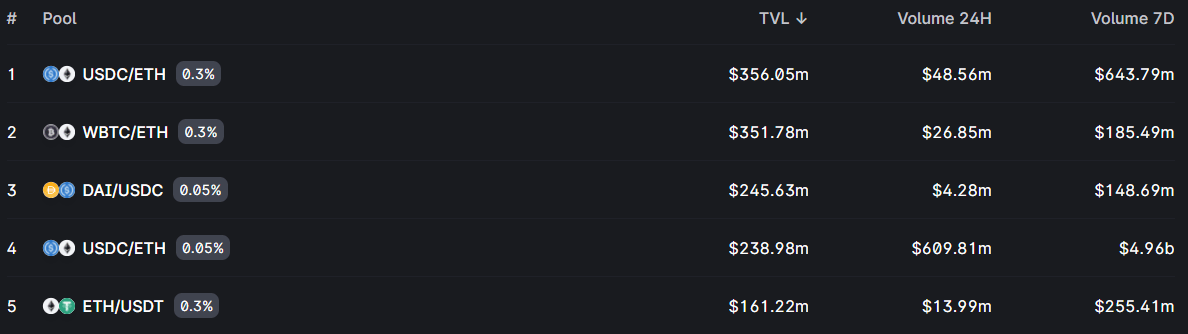

Top liquidity pools on Uniswap

Suppose there are two assets in the liquidity pool, ETH and stablecoin DAI. In order to provide liquidity to the pool, the supplier must deposit both coins in it at an equal value. For example, 1 ETH and 4320 DAI is the current market value of Ethereum in DAI. As long as the market price of ETH remains stable, there are no problems, but as soon as it starts to rise, arbitrage traders will start buying back ETH from the pool until the value of the asset on DEX and on other exchanges is equal.

Due to the fact that the constant K should remain the same, according to the formula, when the price of ETH rises, say, four times from the conditional $ 4,000, the liquidity provider will only be able to withdraw 0.5 ETH and 8,000 DAI from the pool . This means that he will receive less ether, and more stablecoin, because in this way the balance of two cryptocurrencies in a pair is guaranteed, taking into account the growth of the Ethereum rate. That is, in total, he will receive 16 thousand DAI or 16 thousand dollars.

But if LP just kept the coins, and did not send them to the pool, then it would have already had the equivalent of 20 thousand DAI over the same period. The difference of 4 thousand DAI or 4 thousand dollars is that very unrealized loss.

It is called inconstant due to the fact that when the rates return to the previous values, there will be no loss of funds. This means that losses will be recorded only when liquidity is withdrawn and assets are sold.

Risks for Uniswap Liquidity Providers

The calculations above are shown excluding commissions earned by liquidity providers. However, analysts came to the conclusion that even the amount of income from commissions does not fully cover the losses from IL for almost half of LP Uniswap. Here is a quote from Cointelegraph on the subject .

The average liquidity provider in the Uniswap V3 ecosystem has suffered financially from its business choices, and it would be more profitable for them to simply invest their assets. A user who chooses not to provide liquidity can expect the value of his portfolio to grow at a faster rate than someone who actively deposits funds in Uniswap v3 pools.

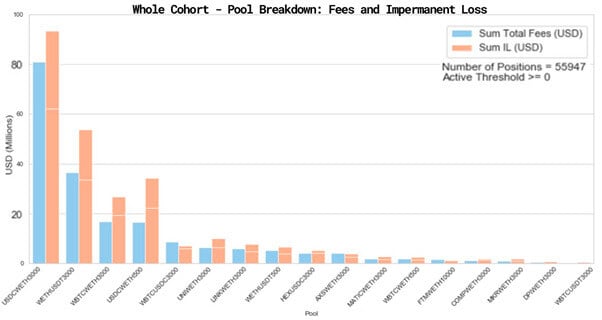

IL volume in the studied pools

Topaz Blue and Bancor Protocol experts surveyed 17 Uniswap pools, which represent 43 percent of the platform's total liquidity. Between May 5 and September 20, they generated $ 199 million in commission revenue for their liquidity providers. During the same time, they incurred IL in the total amount of 260 million dollars.

This means that it would be easier for the owners of capital to keep coins in their accounts. After all, the growth of their rates would provide more income.

For 80 percent of the analyzed pools, liquidity providers lost more on IL than they received commissions. Only in those pools - WBTC / USDC , AXS / WETH and FTM / WETH - the dynamics were positive. In some pools, such as MKR / ETH, losses significantly exceeded LP's revenues.

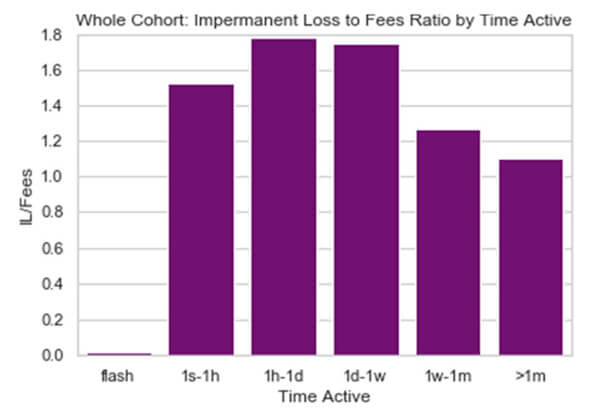

Ratio of IL to commission income depending on the time of liquidity provision

Conclusion: in the aforementioned period, simply buying and holding coins from the pools in your wallet would bring more funds with less risk. However, providing liquidity has its advantages: if the investor expects that the value of the coin will not change significantly in the near future, the LP role will help create an excellent source of passive income.

Post a Comment